Budget and Reserves Update

BUDGET:

At the July 8 regional council meeting, we were presented with a staff report on Options and Considerations for the 2026/2027 budget (here).

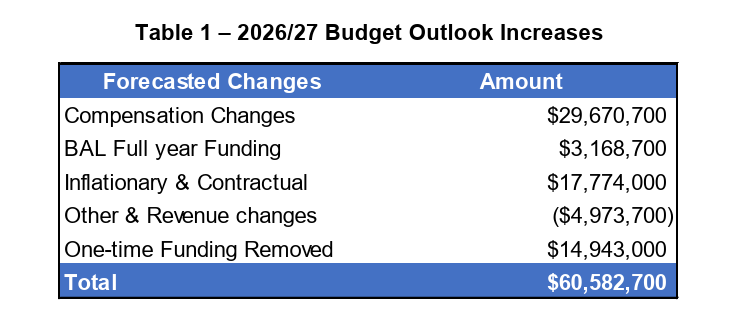

The biggest takeaway was the projected 7.5% tax increase due to contractual changes, inflation, and removal of the one-time funding (as a result of reserve spending I wrote about here) based on our current revenue streams.

To compensate for these increases, proposed changes includes exploring opportunities to diversify revenue streams to reduce reliance on residential taxes, and streamline core service delivery.

The outcome of that report included the following recommendations:

1. Direct the Chief Administrative Officer to return to Council with a proposal for a comprehensive service review framework, including a classification model for core and non-core services, and options for internal or consultant-led execution.

2. Direct the Chief Administrative Officer to return with a corporate user fee policy and pricing strategy, including cost-recovery guidelines, inflation adjustment protocols, and fee exemption criteria.

3. Direct the Mayor to write to the Province of Nova Scotia requesting a formal review of service exchange and mandatory contributions as well as a funding agreement that provides HRM with a share of HST revenue or equivalent ongoing funding, in recognition of the Municipality’s investments in capital infrastructure and economic development.

4. Direct the Chief Administrative Officer to prepare the 2026/2027 budget in accordance with the timeline as outlined in the staff report dated June 10, 2025 (March 31 final approval target).

5. Direct the Chief Administrative Officer to reprioritize the capital plan as well as any new capital asks for the 2026/27 four-year period to ensure that projects advancing in the plan reflect infrastructure investments that deliver the greatest long-term cost savings or cost avoidance for taxpayers, specifically in support of existing municipal core services. This reprioritization is to be undertaken in alignment with the existing capital prioritization framework.

RESERVES:

Also at the July council meeting was an update on HRM reserves (report here). Given the amount of capital projects HRM has or will be taking on in the near future (Windsor Street Exchange, Bedford Ferry Terminal, Burnside Transit Centre, Forum rebuild - to name just a few), reserve funds are a key component to our financial outlook. These funds enable the municipality to save for future expenditures, manage risks, respond to emergencies, and reduce the volatility of tax increases. At present, our current reserves cannot sustain the amount of capital projects we have on the books.

Right now, the Climate Action Tax (CAT) funds the early phases of HalifACT, while the Strategic Initiative (SI) Capital Reserve supports large city-building projects such as mobility upgrades, facility renewals, and growth infrastructure. But with more than $2.6 billion in planned strategic projects over the next decade, it’s clear that these two streams need to work together—not separately.

Of note, the Climate Action Tax and the SI reserve were collapsed to create the Strategic Infrastructure and Climate Fund and using it as a stable, long-term revenue source for climate action and critical infrastructure investments. This reflects our climate improvements, and major capital projects.

This shift also reduces HRM’s reliance on volatile revenue sources like land sales and deed transfer taxes, helping protect residents from unpredictable tax pressures while ensuring we can continue advancing our climate goals.